Future Revenue Prospects

Forecasted Growth

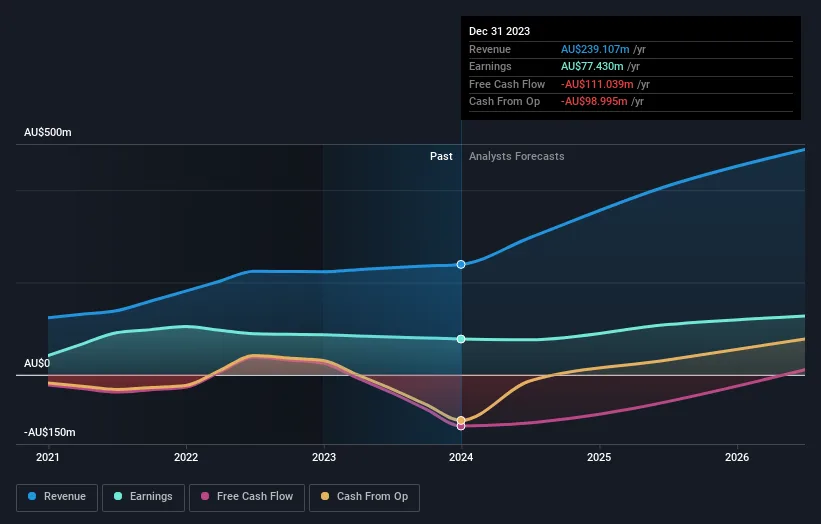

Looking ahead, Lifestyle Communities anticipates a robust revenue growth of 23% per annum over the next three years. This projection significantly outpaces the 7.5% growth forecast for the Real Estate industry in Australia.

Share Performance Analysis

Recent Downturn

Unfortunately, the company’s shares have experienced an 18% decline compared to their value just one week ago. This downturn raises questions about the factors influencing investor sentiment and market performance.

Risk Assessment

Warning Signs

Despite optimistic revenue forecasts, it’s crucial to acknowledge potential risks. Lifestyle Communities currently exhibits two warning signs that investors should be mindful of, signaling areas of concern that warrant further investigation.

Analyzing Investment Outlook

Balanced Perspective

While revenue projections paint a positive picture of Lifestyle Communities’ growth trajectory, recent share price fluctuations and warning signs underscore the importance of a comprehensive risk assessment. Investors should approach investment decisions with a balanced perspective, considering both potential rewards and inherent risks.